What’s missing in West Van’s tax debate

Dundarave at sunset

We are fortunate to live in this beautiful part of the world, between the sea and the mountains.

We have easy access to Vancouver, and are in close proximity to many highly desirable natural features and essentials: parks, the sea wall, library, good transit, beaches, shopping centres and mountain trails.

Many of us feel privileged that to be able to live here; after all, the recent Vital Signs report found that we rate the quality of life in West Van as ‘excellent’.

But the same report also identified our challenges, with housing at the top of the list.

Tax Cuts

In contrast the key message in the platforms of some mayoral and council candidates is municipal spending, with the alluring promise of tax cuts.

Great! Who wouldn’t want to pay less tax? But what services, amenities or infrastructure would be cut as a result?

We love our library, seniors’ centre and community centres; we depend on water and waste management, as well as other essential services; we appreciate our police officers, firefighters, and critical infrastructure; and we certainly enjoy the festivals.

Politicians love to talk about making efficiency savings without necessarily reducing services and impacting our quality of life. But economists the world over will tell you this is not a credible option.

Naturally we all want to see that government - at any level - has prudent financial management, spends our tax dollars efficiently, and runs services effectively.

Strategic Choices

When the mayor and council passed their Strategic Plan they committed to significantly expand the diversity and supply of housing, including housing that is more affordable.

Other priorities included:

Local Economy: Create vital and vibrant commercial centres

Climate Change and Nature: Protect our natural environment, reduce our impact on it, and adapt to climate change

Mobility: Improve mobility and reduce congestion for people and goods

Municipal Services: Deliver municipal services efficiently

Social Well-being: Enhance the social well-being of our community

So if we are to lower taxes, or reduce spending, we would have to eliminate strategic goals or reconsider some the projects or tasks proposed in support of these goals.

Simply declaring “taxes are too high” without also indicating what specific areas of spending should be eliminated isn’t credible politics.

Costs per capita

A report from the right-wing think tank the Fraser Institute arrived in August as something of a godsend to politicians wanting to pad out their fiscally hawkish platforms.

The report states that West Van had the highest per capita spending of all the Metro Vancouver municipalities in 2019.

In fact West Van was in exactly the same position in 2012 - with residents paying the highest per-capita property taxes in Metro Vancouver. The mayor at the time - Michael Smith - is perhaps best known for successive zero percent tax rises.*

There is little offered to contextualise the differences between the municipalities - so no discussion of geographic area, terrain or density; nor any consideration of how the money was spent.

Interestingly a 2014 Fraser Institute report looking at same issue does take the trouble to explain that West Van has a very limited business tax base (7.9% in 2012, compared to an average of 40.7%). This clearly leads to a much greater dependency on property taxes, in contrast to cities where higher contributions from businesses prompts them to complain that they are subsidizing residential taxes.

High costs in West Van

So why are taxes higher here? The North Shore News reported Mike Smith’s response in 2012.

Smith said per capita spending is not a useful way to measure overall financial prudence, especially as West Vancouver has disproportionately fewer families compared to the more affordable Fraser Valley communities.

A detailed explanation contextualising West Van’s particular situation, written by the District’s Chief Financial Officer Isabel Gordon, was published last year. Also included in the latest Five Year Plan, it explains that low population density and difficult terrain mean that the provision of services is more expensive and significantly more difficult than in other municipalities.

West Vancouver is unusual in Metro Vancouver for not having a port or significant industrial base that contributes taxes to the municipality. This is both a benefit and drawback.

How to reduce taxes

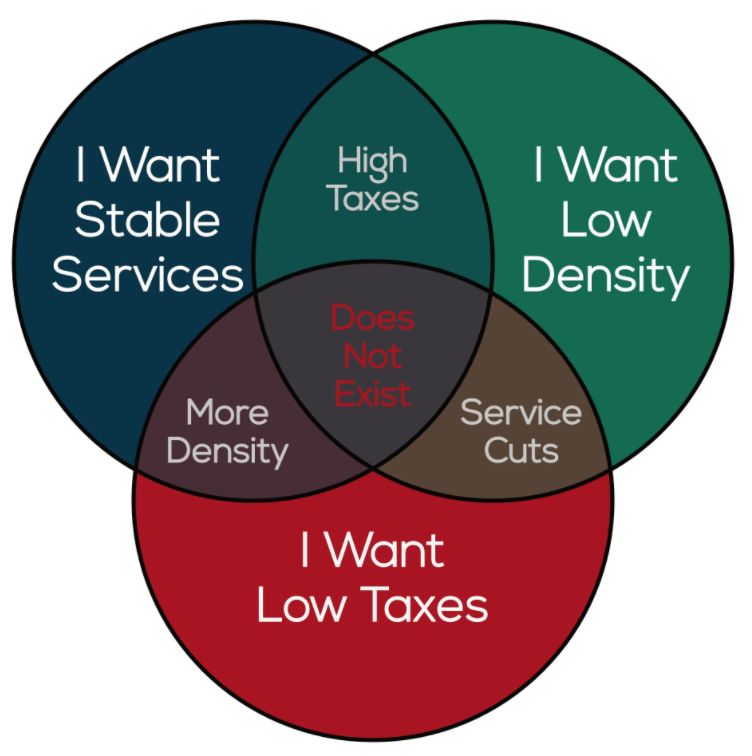

Leaders in West Van have wrestled with the question of how to broaden the tax base over the years and come to the same conclusion. There are only two options:

Introducing industry or other commercial activities.

More taxpayers - either through increased density, or greater sprawl.

The obvious downsides of industry and sprawl are enough to make them non-starters. If we want to continue to enjoy our standard of life in West Vancouver, we should also recognise that compromises - taxes or density - may be in order.

On the other hand they could reduce spending on services. Few politicians will propose to slash programs, facilities, staff, etc. during an election, in the absence of an economic shock.

But if they’ve promised low taxes, and reject density (and more taxpayers), it may be inevitable.

Delay now, pay more later

Mayor Mike Smith’s 0% tax increases meant that assets and infrastructure needing maintenance deteriorated - some beyond repair. Keeping taxes artificially low not only deferred these bills, meant we’d need to find even more money later.

The current council was the first to introduce an asset levy so that reserves could be built up to pay for deferred and ongoing maintenance or replacement.

Without both the asset and environmental levies in place there would be no funds available to cover costs incurred if or when critical infrastructure fails.

We have seen the impacts of climate change directly on our doorstep (Ambleside flooding, heat dome, creeks such as John Lawson running dry).

We’ve seen that avoiding the issue would mean even higher costs later, so it’s vital our municipality makes provision for the necessary climate adaptation required.

Your Mayor and Councillors - your choice!

Please vote!

The decision made by our mayor and council affect us all.

Use your vote, and ask everyone - friends, relatives and neighbours - to get registered, and use theirs.